How to Void a Check: A Step-by-Step Guide

Voiding a check is a simple process, but it’s an important step to ensure the check can no longer be used. Whether you’re setting up direct deposit, making a payment, or simply want to prevent a check from being cashed, knowing how to void a check is essential.

In this guide, we’ll cover the step-by-step process for voiding a check, explain when you might need to void a check, and provide tips on securely handling voided checks.

What Does It Mean to Void a Check?

Voiding a check means marking it as unusable so that no one can cash or deposit it. The check is rendered invalid for financial transactions, but it can still be used for other purposes, such as providing your bank account information for direct deposit.

When Should You Void a Check?

There are several common reasons you might need to void a check:

- Setting up direct deposit: Employers may request a voided check to collect your bank account details for payroll.

- Automatic bill payments: Companies may ask for a voided check to set up recurring payments from your bank account.

- Fixing a mistake: If you’ve made an error while writing a check (wrong amount, wrong payee), voiding the check ensures it can’t be used.

- Canceling a check: Voiding a check prevents it from being processed if you no longer need to issue it.

How to Void a Check: Step-by-Step Instructions

Voiding a check is straightforward. Follow these steps to void a check correctly:

Step 1: Use a Black or Blue Ink Pen

To ensure the check is properly voided, use a permanent pen with black or blue ink. Avoid using pencils or erasable pens, as they can be altered or removed.

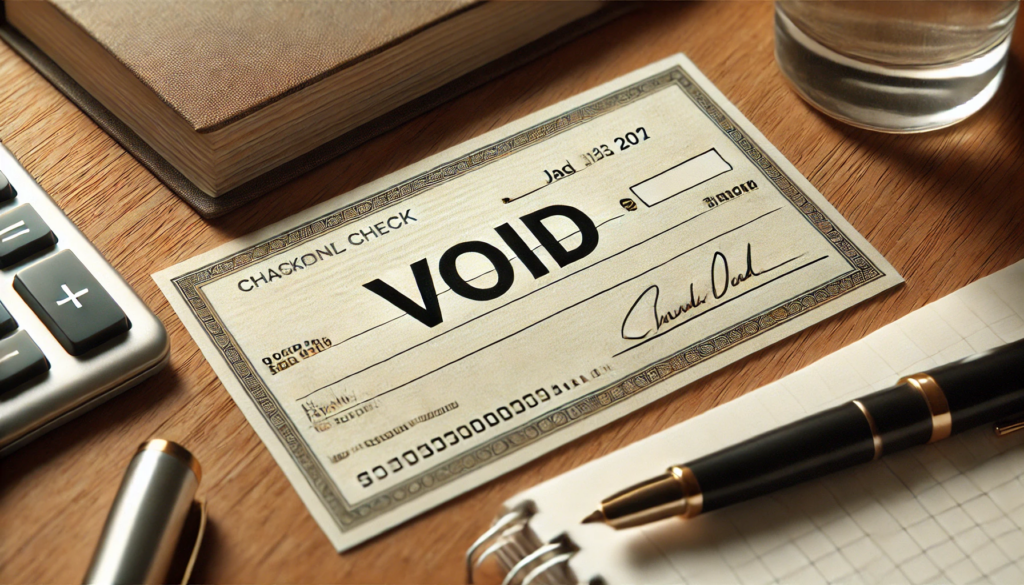

Step 2: Write “VOID” Clearly Across the Check

Write the word VOID in large, clear letters across the front of the check. You can place it in the following locations:

- Across the payee line (where the recipient’s name is usually written).

- Across the amount line (where the check’s amount is written).

- Across the entire check, covering the payee, amount, and signature areas.

Make sure the word “VOID” is large enough to be easily seen, but don’t cover the bank’s routing or account numbers at the bottom. These numbers may still be needed for things like direct deposit.

Step 3: Record the Void in Your Checkbook

Even though the check is voided and cannot be used, it’s a good idea to record it in your checkbook or transaction register. Mark the check number as voided so you have a clear record of why that check won’t be processed.

Step 4: Store the Voided Check Securely

If you’re voiding the check for personal reasons, such as canceling it, store the voided check in a safe place for your records. If you’re sending the check to someone for direct deposit or automatic payment setup, make sure to handle the check securely and only provide it to trusted parties.

How to Void a Check for Direct Deposit

When setting up direct deposit with an employer or a financial institution, you may need to provide a voided check to verify your bank account information.

Step-by-Step Instructions:

- Write “VOID” on the check:

- Follow the standard procedure of writing VOID across the front of the check.

- Submit the check:

- Attach the voided check to the direct deposit form or submit it electronically, depending on the employer’s or institution’s requirements.

- Ensure security:

- If submitting the check in person, deliver it securely. If submitting it electronically, ensure that the check is sent over a secure system.

How to Void a Check for Automatic Bill Payments

Some companies request a voided check to set up automatic bill payments from your bank account.

Step-by-Step Instructions:

- Void the check:

- Write VOID across the check as described earlier.

- Submit the voided check:

- Attach it to the payment authorization form or provide it to the company directly.

- Review your bank statements:

- Once the automatic payment is set up, regularly review your bank statements to ensure the payments are being deducted correctly.

How to Void a Check After It’s Been Sent or Cashed

If you’ve already sent or cashed the check and want to void it, you’ll need to cancel or stop payment through your bank rather than simply voiding the check.

Step-by-Step Instructions:

- Contact your bank:

- Reach out to your bank’s customer service or visit a branch and request a stop payment. You’ll need to provide details like the check number and amount.

- Request stop payment:

- There may be a fee for this service, which varies depending on your bank.

- Monitor your account:

- Check your account regularly to ensure the payment does not go through.

Common Questions About Voiding a Check

1. Can a voided check be used for fraud?

- Even though a voided check cannot be cashed, it still contains your bank account and routing numbers. Make sure to provide voided checks only to trusted parties and store them securely.

2. Can I void a check that I already wrote?

- Yes, you can void a check you’ve written but haven’t sent. If the check has been sent or cashed, you’ll need to request a stop payment from your bank.

3. What happens if I don’t void a check properly?

- If a check isn’t properly voided, there’s a risk that someone could attempt to use or cash it. Always write VOID clearly across the check to prevent this.

4. Can I void a check digitally?

- Some banks and companies allow you to submit a digital voided check through their online portal. In this case, you can often upload an image of the check with “VOID” written across it.

How to Void a Check: Quick Reference Table

| Step | Instructions | Best For |

|---|---|---|

| Use a pen | Use black or blue ink to ensure the check cannot be altered | Ensuring a clear voided check |

| Write “VOID” on the check | Write “VOID” in large letters across the front of the check | Preventing the check from being used or cashed |

| Record in checkbook | Mark the check as voided in your transaction log | Keeping track of voided checks |

| Store securely or submit | Store the check in a safe place or submit it to the appropriate party | Handling voided checks safely |

| Request stop payment (if needed) | Contact your bank if the check has already been sent or cashed | Stopping payments after sending |

Conclusion

Learning how to void a check is a simple yet essential skill for managing your personal finances. Whether you’re setting up direct deposit, canceling a check, or correcting an error, voiding a check ensures that it can’t be used for unintended purposes. Remember to always handle voided checks securely and provide them only to trusted parties.

For more financial tips and how-tos, visit AnswerHowTo.com, your trusted source for practical advice.